DE | EN

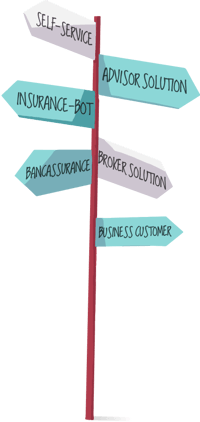

Our API-based products enable the design of individual advisory solutions according to the ideas and needs of our customers (content, front-end customization, colors, fonts).

The modular structure is not only an advantage for the individualization of the solutions, but also enables a short implementation time. Our solutions support lead generation, advice and closing on all sales channels.

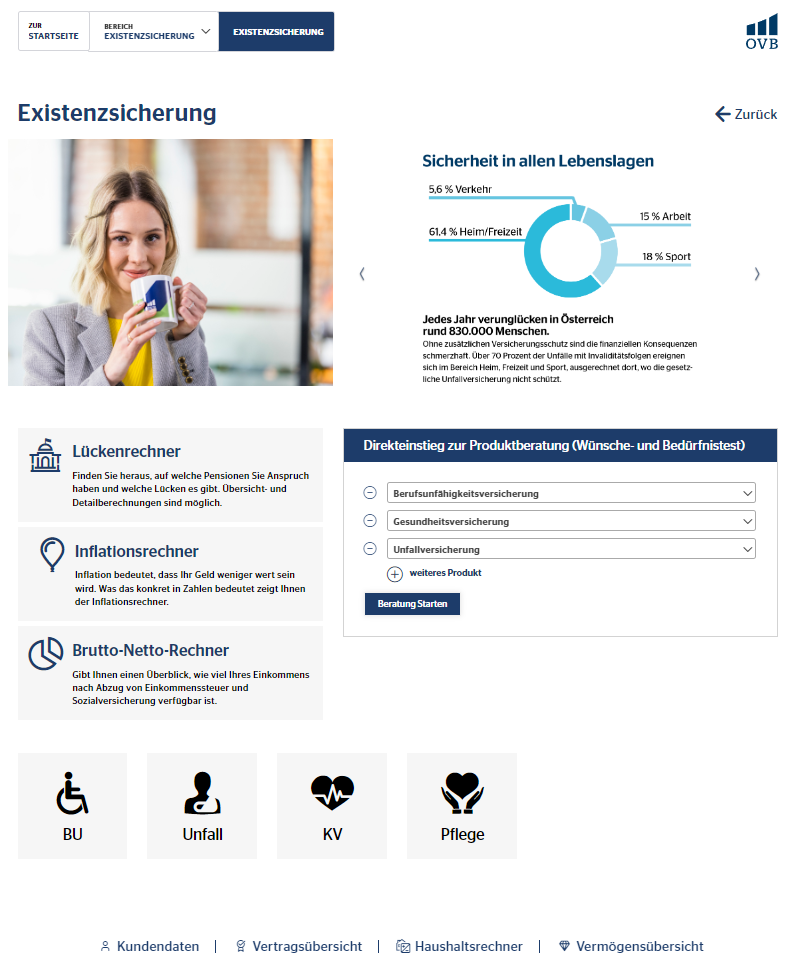

Self-Service

Create additional digital touchpoints for customers.

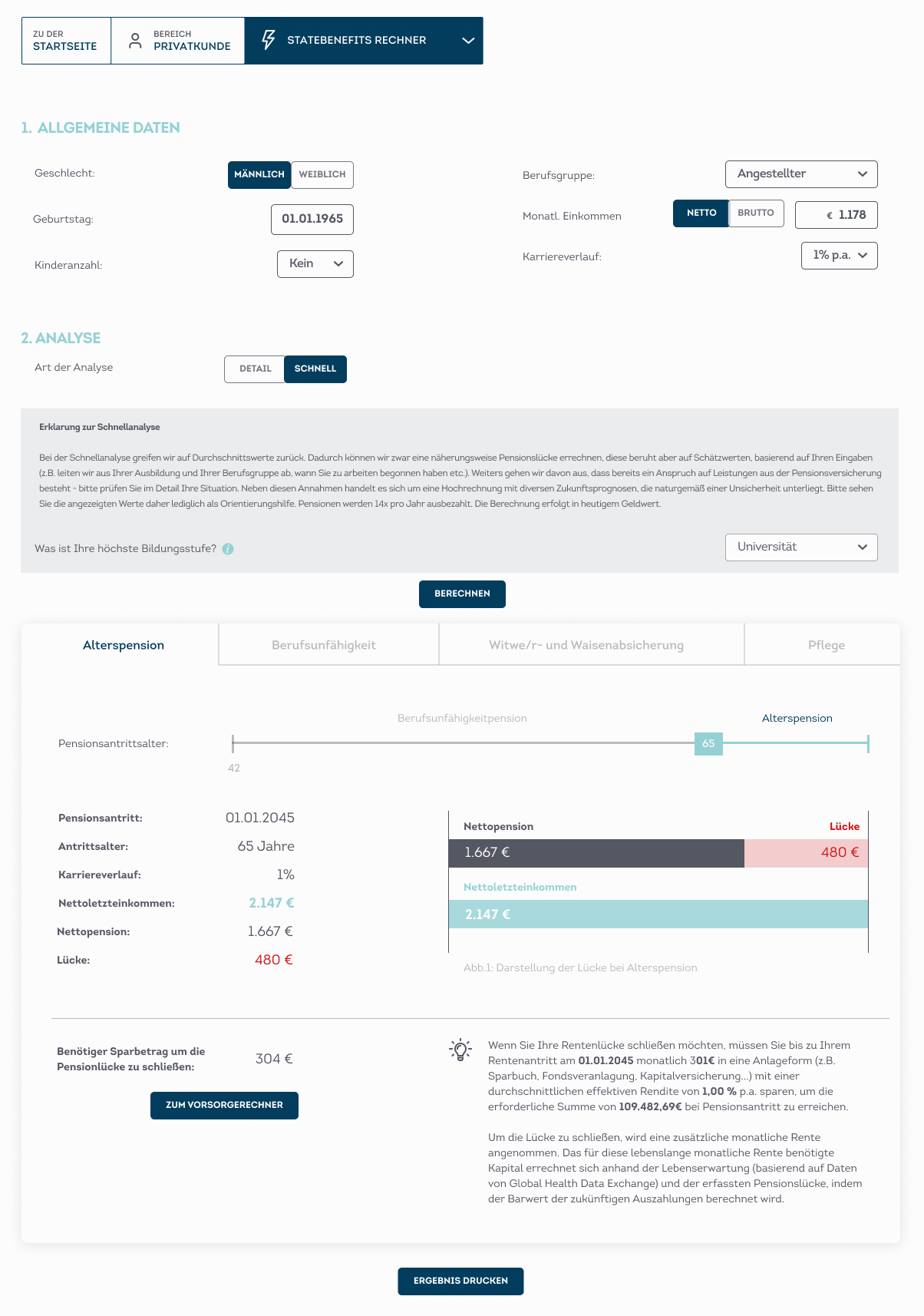

The integration of self-service solutions creates more flexibility for customers without losing high quality advice. The possibilities range from calculating pensions and household budgets over to holistic advisory paths and annual self-checks. By using our API-based solutions customers can manage their concerns easily via website, portal, or app, regardless of business hours. This not only gives end customers more flexibility, but also results in an increase of high quality leads. Thanks to direct connections to existing systems, data is updated in real time, making time-consuming data entries and reviews no longer necessary.

An overview of all the products can be found here.

Product Advisory: Unit-linked life insurance

Holistic, IDD-compliant advice in 4 steps.

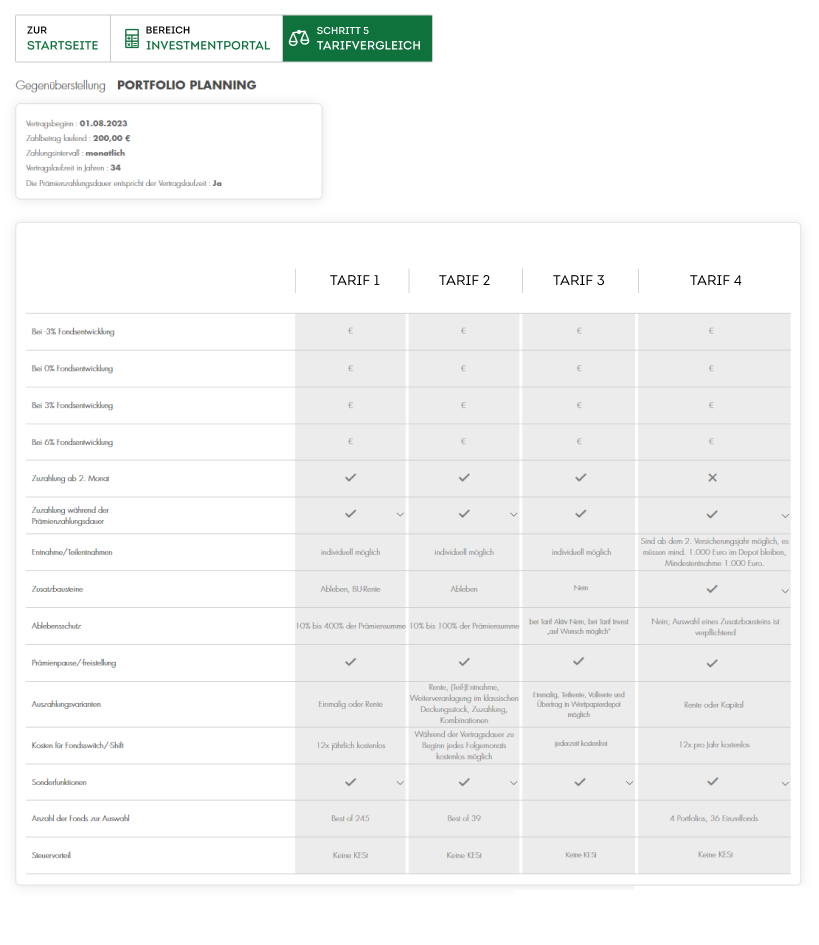

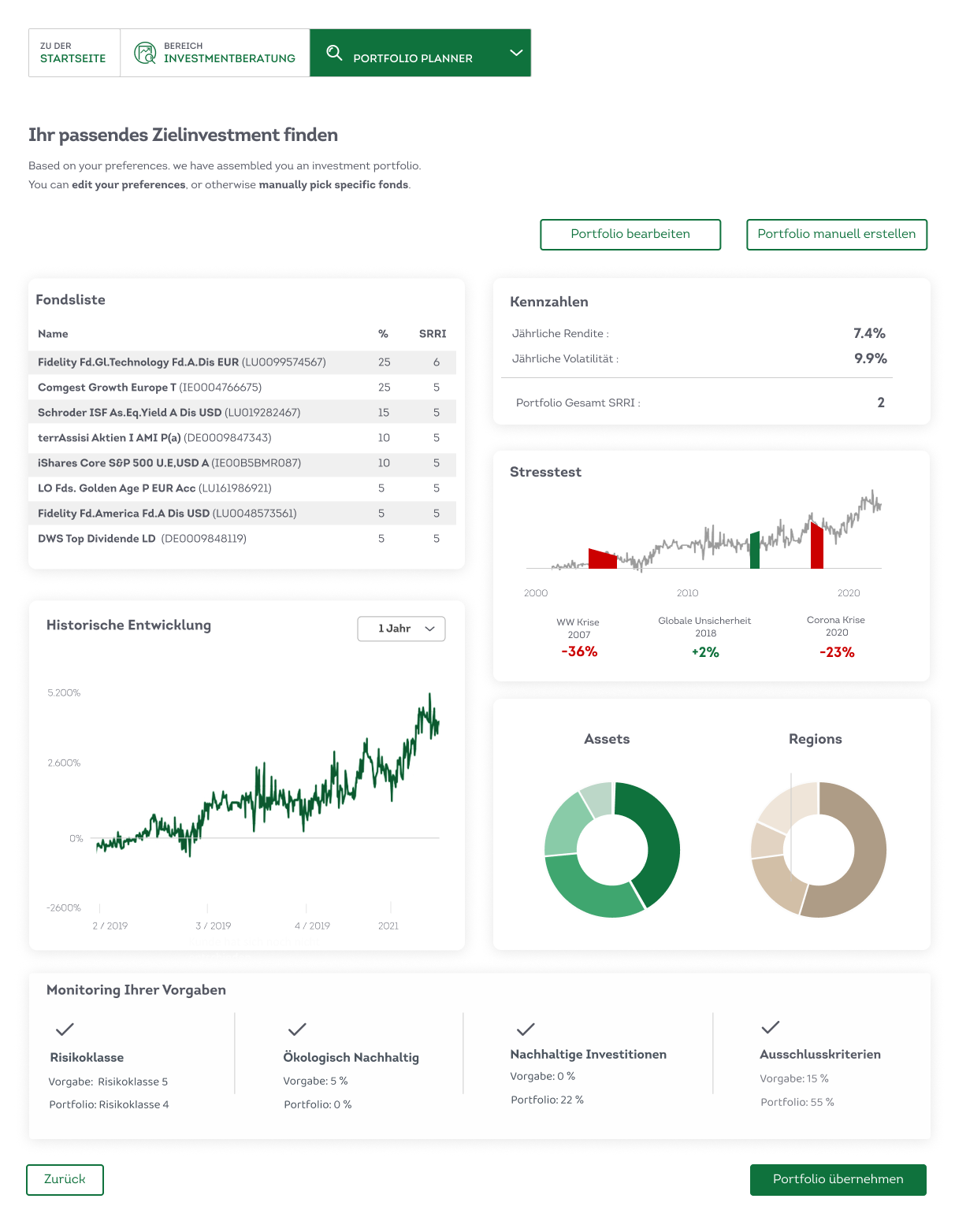

Unit-linked life insurances are one of the most complex products in the insurance industry, why a completely integrated process is even more important to ensure a good and transparent advice. We cover regulatory requirements, product configuration as well as the comparison of different product variants. According to the given information of your customers, the optimal fund portfolio is generated with one click and the offer (including documentation) is created seamlessly. In this way, we not only guarantee efficient and holistic advice, but also ensure a customer-centric approach with full transparency for end customers.

4 steps in a nutshell:

- IDD compliant advisory including appropriateness and suitability test & ESG

- Product configuration & display of different product variants

- Portfolio planning

- Application preparation

See our PRO Demo Version to click through our products and solutions.

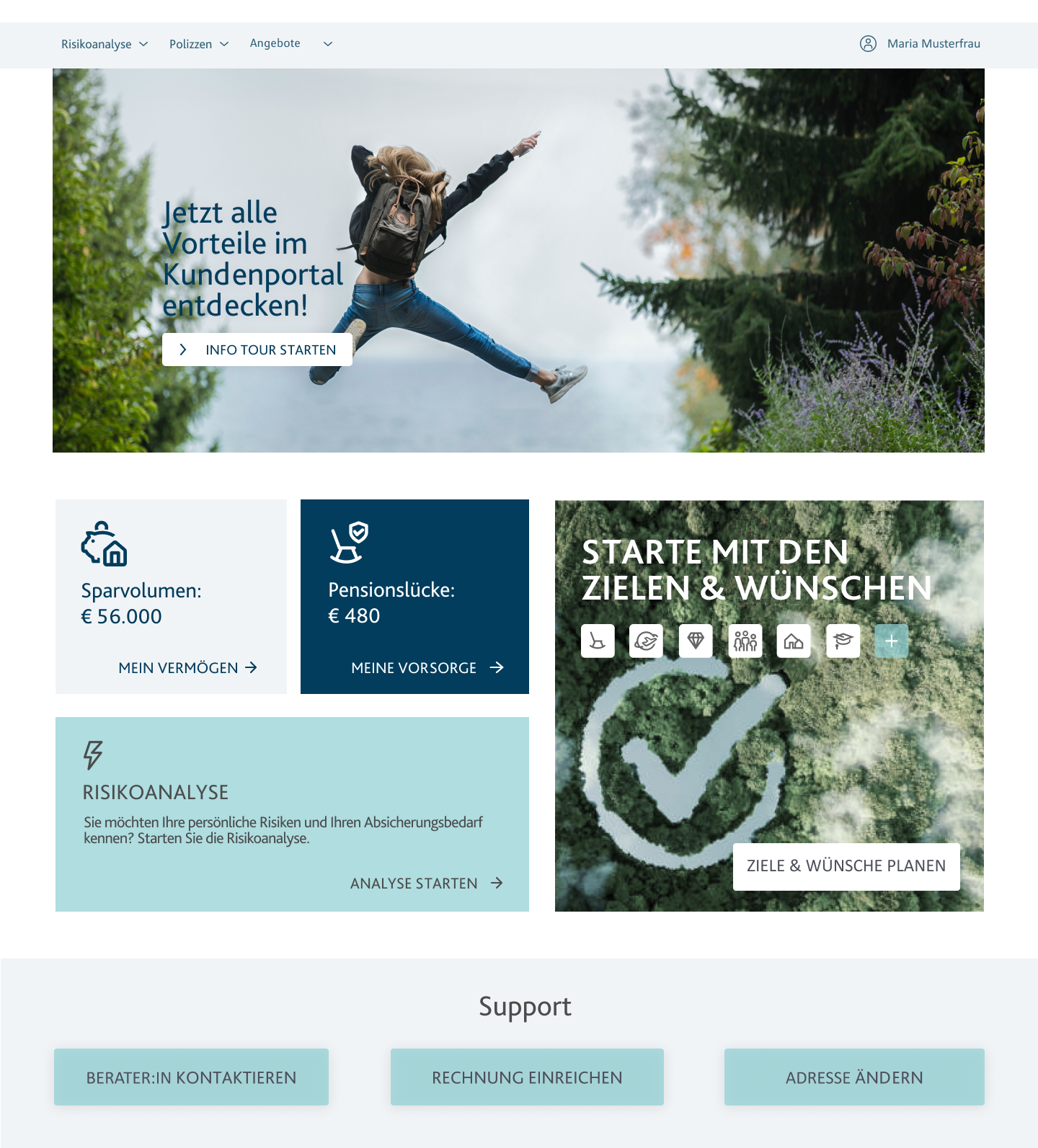

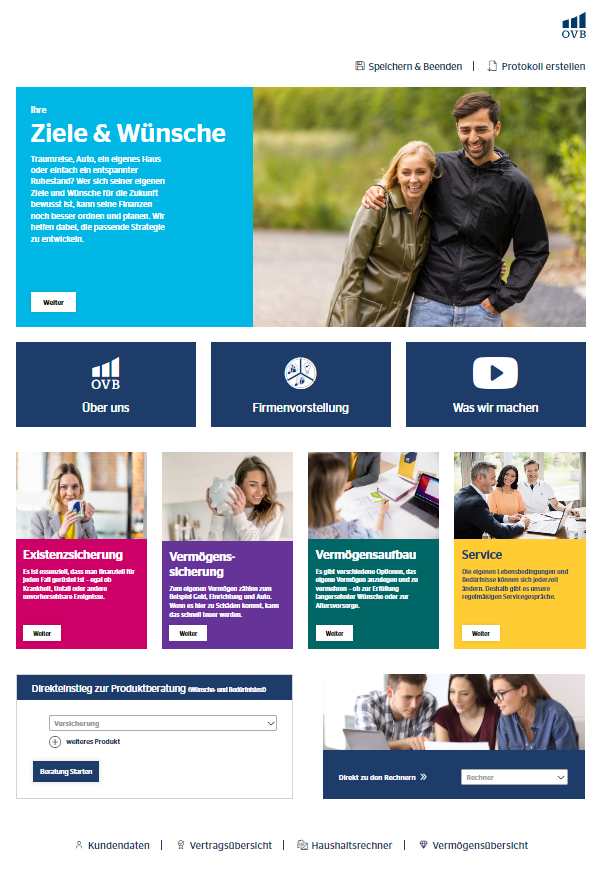

Holistic solutions for advisors

Individual advisory paths increase the quality of customer service.

Duplicating data entries are a thing of the past when implementing a digital advisory solution. Thanks to our API-based modules, riskine products can be combined individually. We make sure to design individual solutions according to requirements, ranging from an objective risk analysis to a needs assessment over to a full product advisory path. Customer-centric advisory solutions not only improve the quality of consulting and increase the customer satisfaction, but also have a positive effect on your sales performance (more X-selling, higher premiums, less churn).

See our PRO Demo Version to click through our products and solutions.

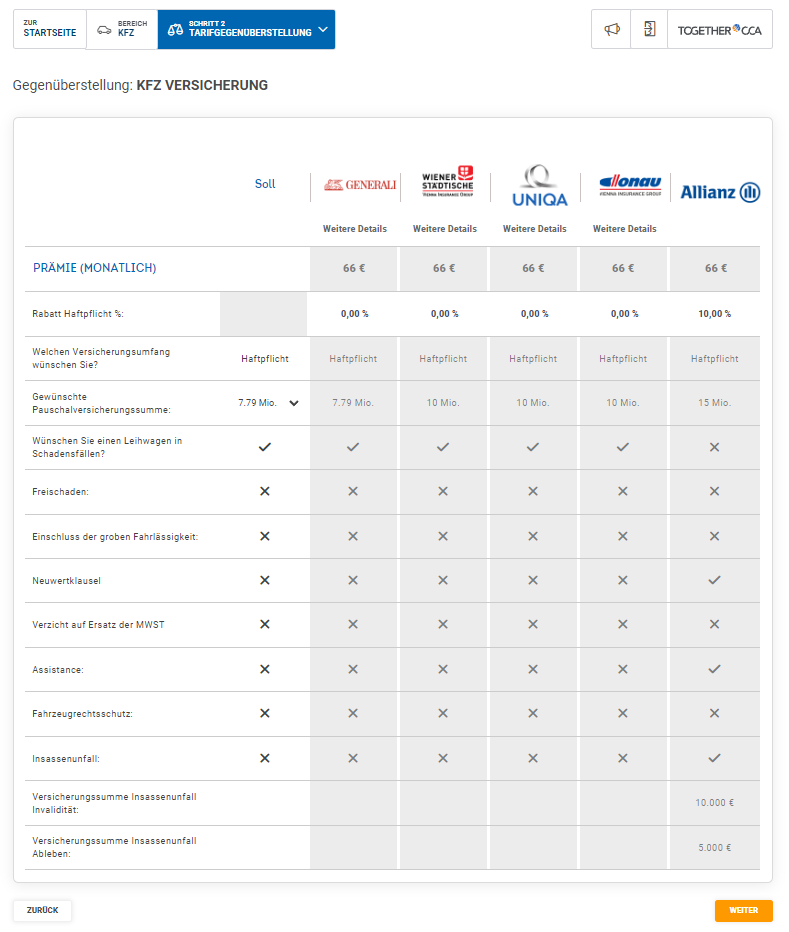

Broker solution for private and business customers

Customer-centric advisory solutions to optimize broker sales.

Leading brokers in the business sector have been relying on our advisory solutions for several years. Starting with the holistic risk analysis, to the digital application and offer, we enable brokers with different professional experience to make sound commercial consulting. Insurance companies and brokers benefit equally from the use of an integrated solution as the holistic implementation not only creates additional X-selling potential, but also reduces complexity in the application and saves time and costs. In addition, all insurance tariffs are directly linked to our solution, including shadow processing via third-party systems.

You want to know more about our broker solutions? Contact us.

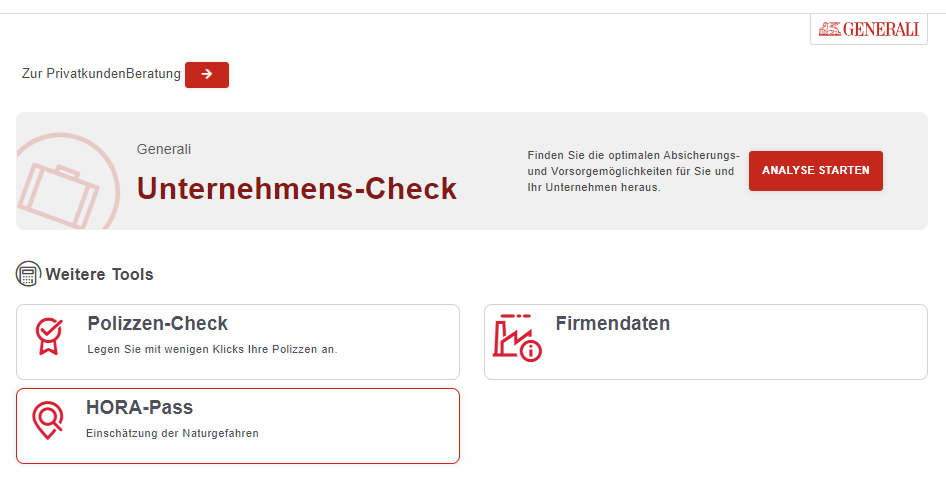

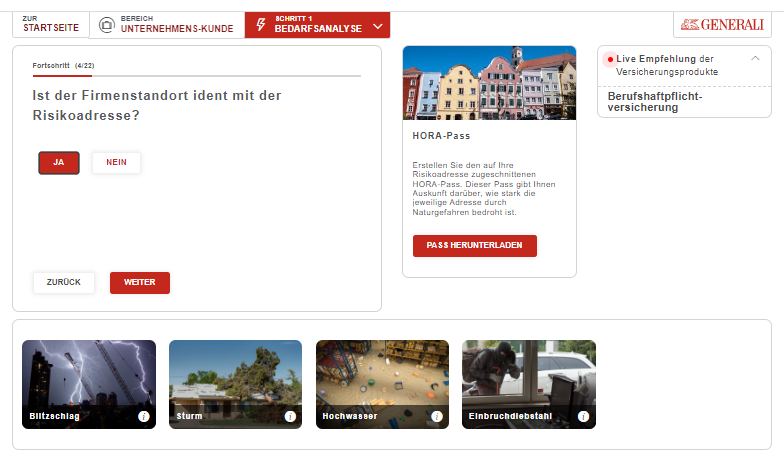

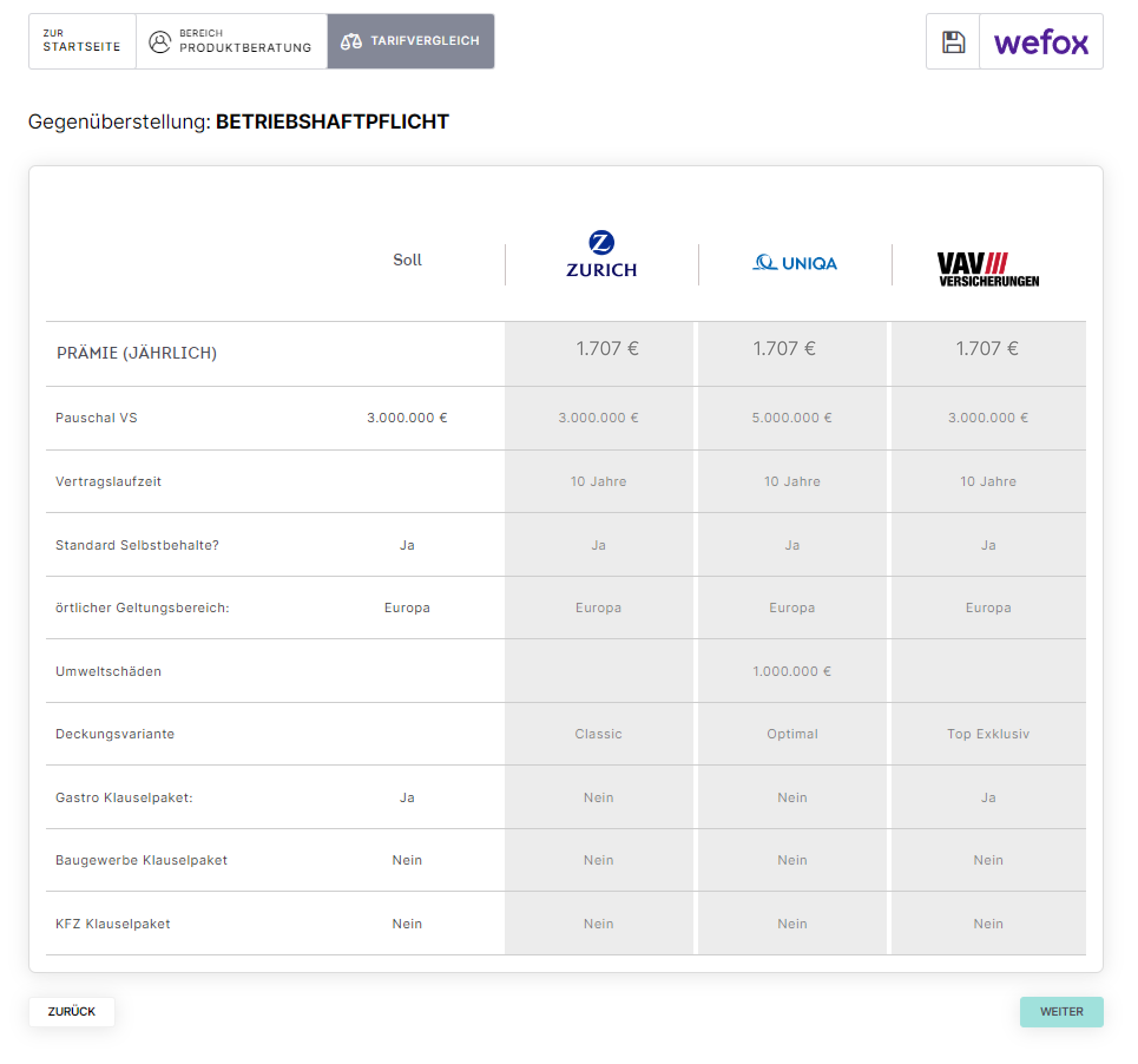

Business Customer Advisory

Efficient insurance advisory for business customers.

Together with Generali Austria we developed a solution to support the insurance advisory of commercial customers to comprehensively record their risks and needs. We enable an end-to-end digitalized process from the needs assessment to the digital offer and the conclusion for 1000+ industries. Product and industry-specific advisory paths can be customized based on our modular Advisory Suite. Our growing ecosystem of plugins (z.B. ESG-Analyser, NAT-Kat risk, credit check etc.) further enriches the advisory experience and creates transparency for business customers. .

You can find details about our solutions for business customers here.