riskine`s risk model for your advisory success

In our opinion, the basis of first-class insurance advisory includes to calculate risks objectively, make them understandable and transparent and transfer them into product prioritizations as well as recommendations. Our vision is to evaluate risks in a way that suitable & conscious financial decisions can be made.

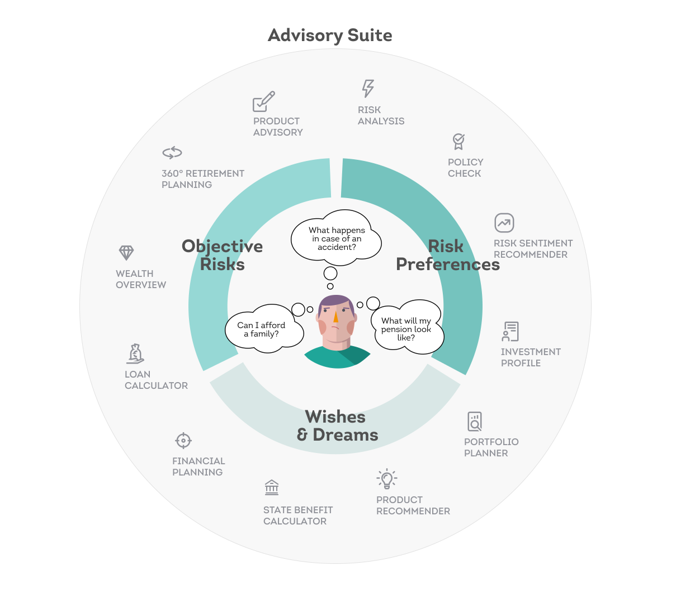

riskine 360° customer view

As confirmed by a recent study, conducted by the wissma institute, our data-based, objective approach of evaluating, preparing and communicating risks also increases confidence in your product recommendations and strengthens your customers' desire for coverage. A win-win situation? For sure!

Holistic risk identification - the way to success

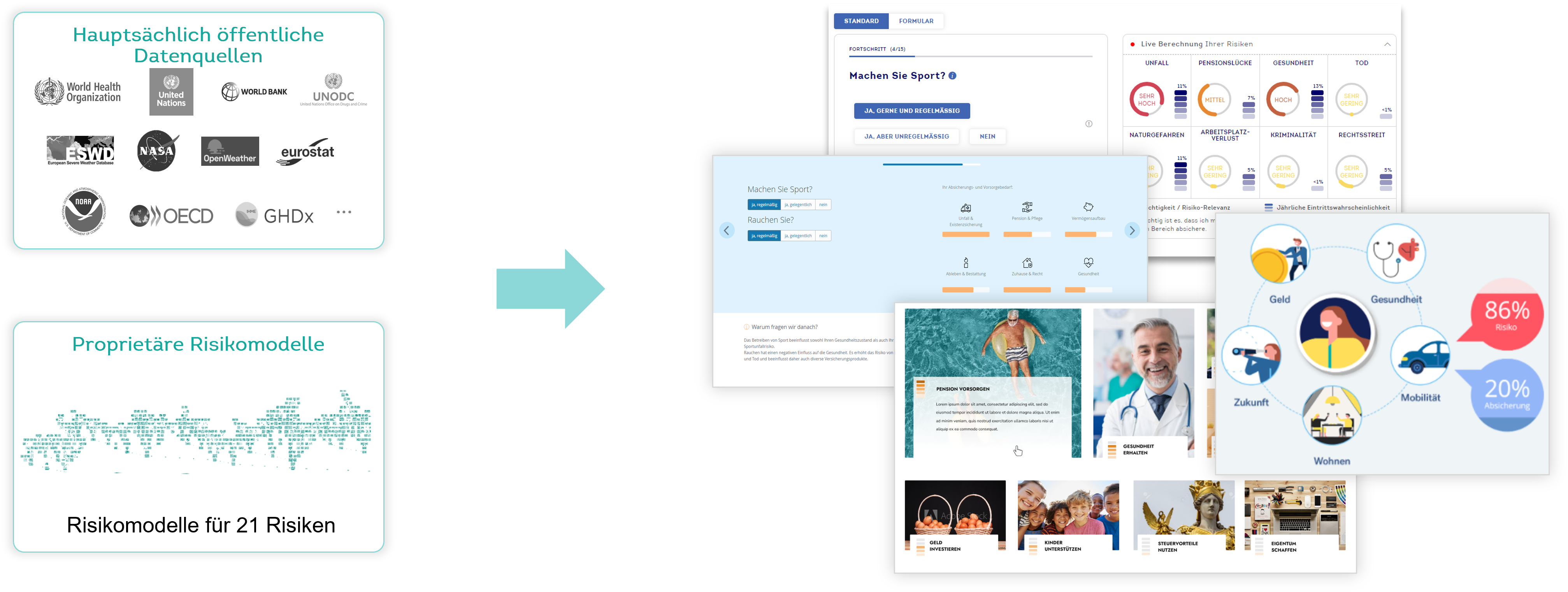

Our solutions and calculators are based on risk models and data, which, on the basis of the latest technologies, are used in highly intelligent advisory paths.

Risk data - Intelligent use for insurance advice

Our approach of mapping publicly available data with our intelligent risk model results in a variety of highly customized solutions: From initial risk and need analysis, to AI based real-time risk models, and product configurators & comparators that support you in providing individual customer advice.

One example is the holistic identification of your customers' risks and needs ("riskine risk analysis“).This solution is based on individual questions to identify the objective risks, subjective needs and risk preferences of your customers. These are mapped into customized product recommendations. This makes the risks and product recommendations comprehensible and transparent for both advisors and customers, which in return leads to better consulting, sustainable customer relationships and more cross-selling (up to 35% p.a.).

DIN 77230 and our risk mapping, it's a match!

Our approach of mapping, evaluating and ranking risks corresponds with DIN 77230. By integrating our risks and algorithms, you can illustrate the risks to your customers during the DIN consultation and thus offer your clients a comprehensive and interactive consulting experience.

Our solution for insurance sales - confirmed once again

There are even more benefits from using our solution, which the recently conducted study* by the market research institute wissma confirmed:

1. Identification of the most relevant risks

The holistic analysis gives your customers information about their most relevant risks based on objective data. A clear overview and prioritised recommendations show customers their greatest needs for protection and which insurance products make sense in each case.

2. Trust in your product recommendation

The objective and transparent identification of risks in advance leads to more trust in your product recommendation. The risk analysis offers customers an overview & objectivity and provides advisors with a tool that turns them from their role as "salesperson" into advisors at eye level. The beginning of the consultation is based on the neutral assessment of the preceding analysis and is a good basis for an excellent advisory conversation.

* Study design: 18 psychological in-depth interviews; April-May 2021; 90-minute guided interview setting including accompaniment during the independently conducted riskine risk and needs analysis

You want to learn more about our highly specialized and individualized solutions for your advisory processes? Arrange a short intro appointment or write to us here. We are looking forward to it!