Digital advisory solutions for your business customers

Digitalisation is already in full progress in the private customer advisory. But what about the advice for business customers? Business customers are also increasingly demanding digital solutions for the optimal handling of their insurance matters. Today we present a solution which you should definitely get to know.

Digital advisory paths

Time & cost savings through guided digital process

If we talk about digital business customer advisory services, it is not only about digital applications that the business customer can use completely independently (in self-service), but rather about consistently digitalised processes that considerably facilitate complex advisory services. This results in advantages not only for advisors and brokers with less experience, but also for experts in this field. Insurance companies can use digital solutions to boost sales and save costs.

We support you in the digital advice of your business customers, in simplifying special organisational challenges and in providing holistic, industry-specific advice. Over the last few months, we have worked intensively on the further development of the solution and have taken it to the next level. The result: a holistic and fully digital advisory solution from risk analysis through the product advisory paths to tariff comparison and product conclusion.

Did you know? Many of our products are also suitable for the self-service of your customers! For example, our Insurance Bot can handle your customers' requests 24/7 and provide regular risk checks for them.

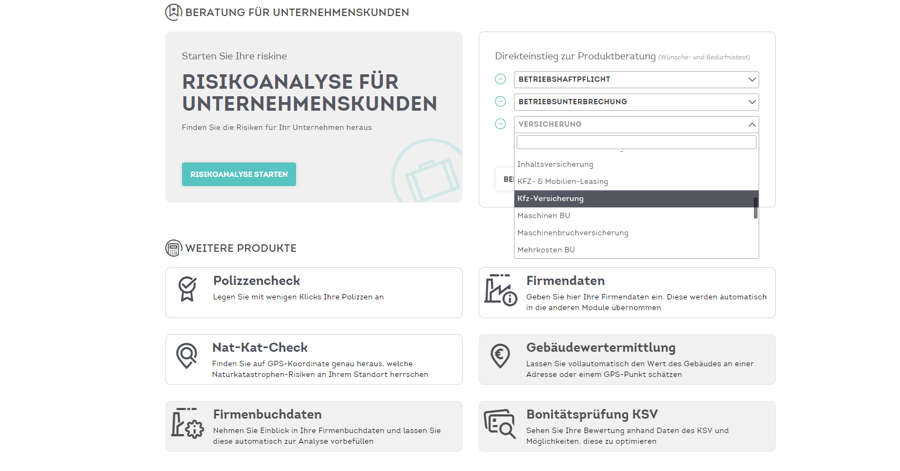

riskine’s digital advisory solution for business customers in detail

Holistic and digital - for the highest quality in advice

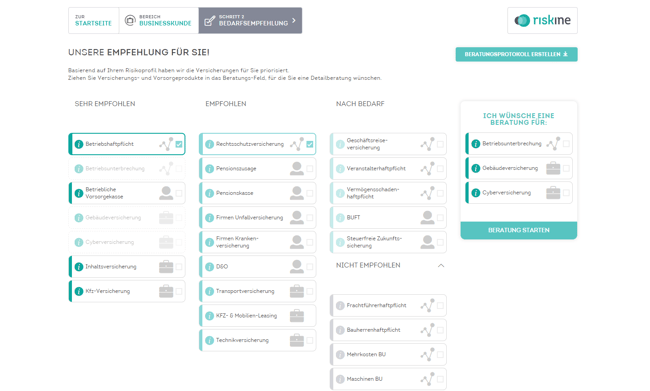

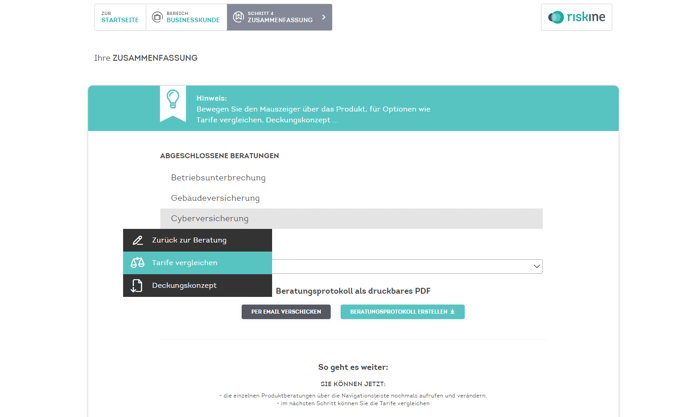

The solution starts with the risk analysis, which leads to a clear product recommendation. In this way, your business customers' needs are shown transparently, and considerable cross-selling opportunities arise for you. The further advisory paths on 30 different insurance products contain industry-specific questions and generate a comprehensive coverage concept for the tender as well as an IDD-compliant consulting protocol. The questions are individually adapted in real time to your business customers depending on the answer. The efficient advisory paths also provide valuable information for advisors and ensure quality during the entire advisory process.

New for you and your business customers is a consultation that can be completed fully digitally. After the automated creation of the offer, it can be compared in an overview and, if required, an application can be generated directly in the solution. Also the automated processing for selected products is already in progress. The digitalisation of the tariffs of insurance companies will simplify the connection to brokers. Thus, advisors, brokers as well as business customers benefit from an efficient, consistent advisory right up to the conclusion of the contract.

Tip: The digital solution can also be optimally used for remote advisory (e.g. via screen sharing).

API-based architecture for individual solutions

Due to our API-based technology, your advisory solution will be individually compiled and adapted according to your requirements (design, question paths, front-ends, extension by calculators and additional modules etc). Business customer advisory services can be combined and extended as desired with the products in our Advisory Suite. In order to offer you a complete solution for your customer advice, we also integrate third-party plug-ins into our platform. A new integration partner is the KSV1870, which automatically transfers company data and performs a comprehensive credit check.

Did you know? All our solutions can be combined and extended with products from our Advisory Suite!

Sebastian Ratcliffe, our product manager of the business customer advisory, will be pleased to introduce our solution and your individual application possibilities in more detail.

riskine breaking news

- We were asked for our opinion on digital business customer advisory for an article in the "Versicherungsjournal Spezial: Gewerbeversicherung". A first fully digital solution was recently successfully launched and presented in more detail in the magazine AssCompact.

j - At the IFA (Insurance Forum Austria) Rust 2020 our CEO, Ralf Widtmann, hosted the roundtable "Künstliche Intelligenz im Versicherungsvertrieb". The article "Mehr künstliche Intelligenz im Vertrieb?" was published in the Versicherungsjournal.

j - Our CTO, Johannes Seebacher, gave an insight into our sophisticated API ecosystem at the API Economy Conference from Versicherungsforen Leipzig. Click here for our API documentation.

Stay happy and healthy,

your riskine Team

We are happy to hear from you: marketing@riskine.com

For even more insights you can also follow us on LinkedIn