Insurance Bot along the Customer Journey

In our last newsletter, we already presented solutions for lead generation and self-service. Today, we turn our attention to a core element of self-service advisory: the intelligent insurance chatbot. Our white label bot "Risky" is pre-trained with comprehensive insurance knowledge and is used in many ways. Today we present an excerpt of his knowledge and application possibilities as well as some of his intelligent, highly specialized bot siblings.

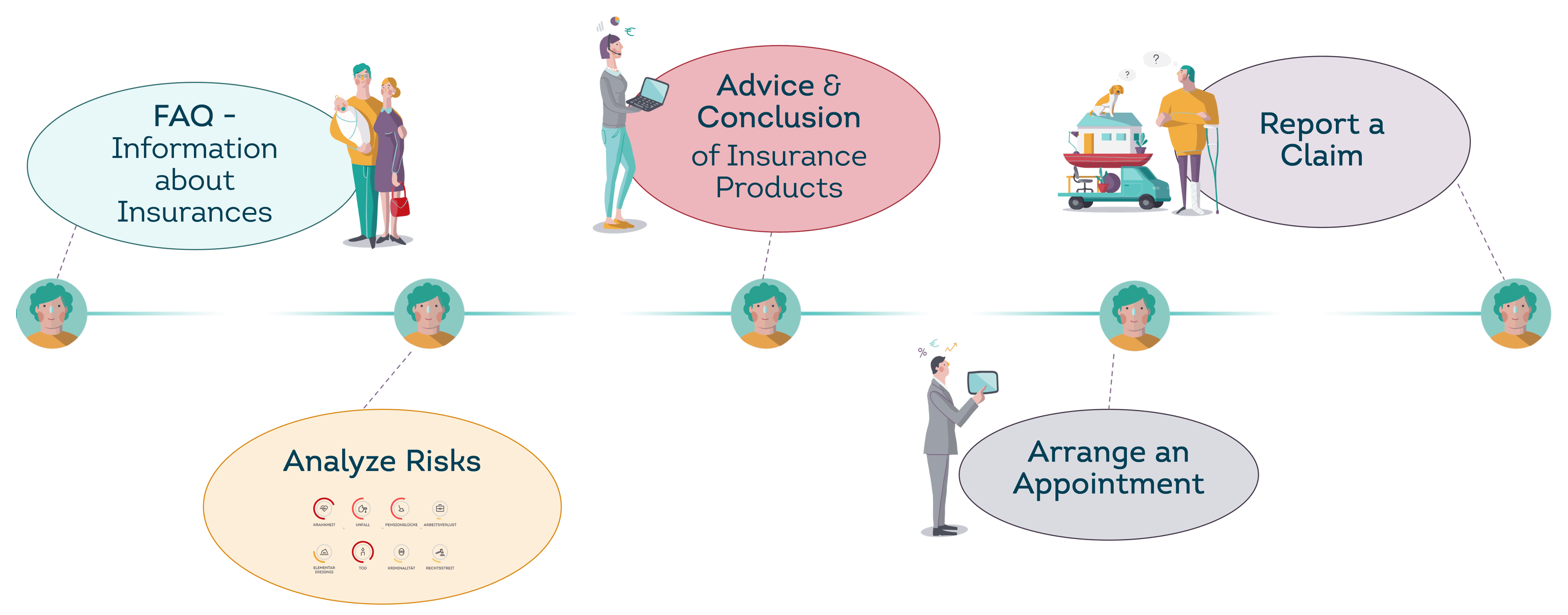

Chatbots in insurance consulting assist your customers along the entire customer journey and support advisors in lead generation and advice. This allows you to pick up digitally affine customers and serve them 24/7. The following use cases are the specialties of our white label bots.

Chatbot Use Cases along the Customer Journey

Selected family members introduce themselves...

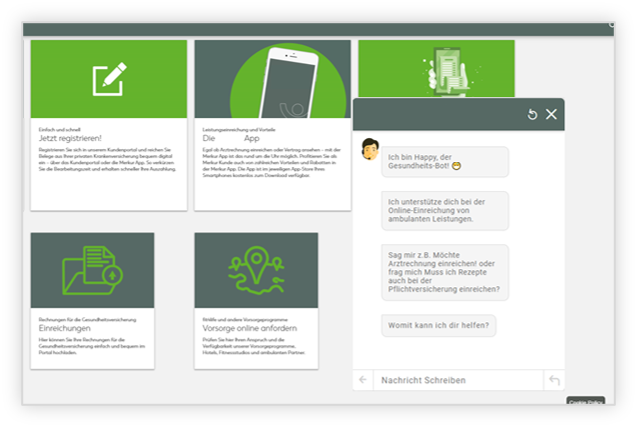

At our partner, Merkur Insurance, "Happy" provides support in both the customer portal and the app. It helps customers file claims online, answers questions about various Merkur services and makes customers not only safer, but also happier.

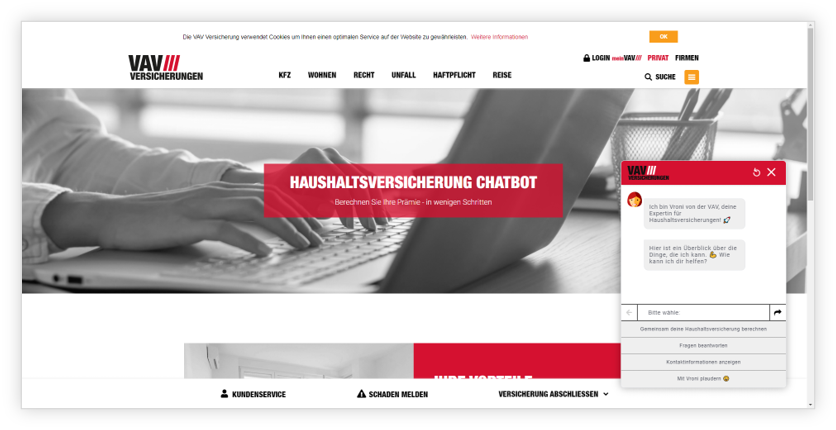

Chatbot "Vroni" serves customers of VAV Insurance on their website. With her understanding of insurance, Vroni is the expert on the topic of household insurance and advises customers 24/7 on their wishes and concerns, right up to the conclusion of the contract.

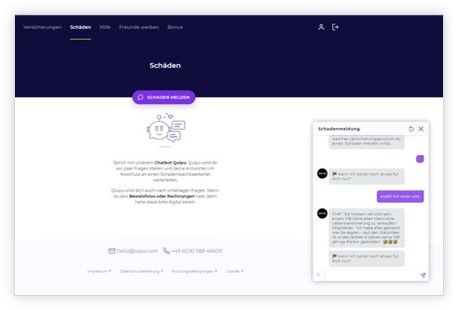

Quipu

Quipu supports Coya customers quickly and easily in submitting claims – around the clock. Our genius grew up bilingual and has quite a sense of humor.

How do you get your specific insurance bot?

Your individual bot will be aligned with your corporate design as well as with your requirements and needs in terms of content - a real B2B bot, from specialists for specialists. Depending on your requirements, the implementation time is about 2-5 months until go live. We would be happy to show you further features of the most intelligent insurance bot or discuss your possible use case in a non-binding demo call.