Customers are not digital, but convenient.

What does it really take to increase interaction with customers? Which content is relevant? How “attractive” does a customer portal have to be that it’s actually used? If you want to be closer to your customers, you are probably asking yourself these questions. Reason enough to take a closer look at this topic and to show possibilities of a customer-oriented self-service solution.

However, various digital solutions are not only important for existing customers, but also for opening new customer segments. That’s why we do not focus exclusively on private customers but are also constantly developing our solutions for business customers.

What to expect?

- Self-Service: increase customer interactions

- Business customer solution: new upgrade for the win

- Portfolio Planner: regulatory compliant advisory

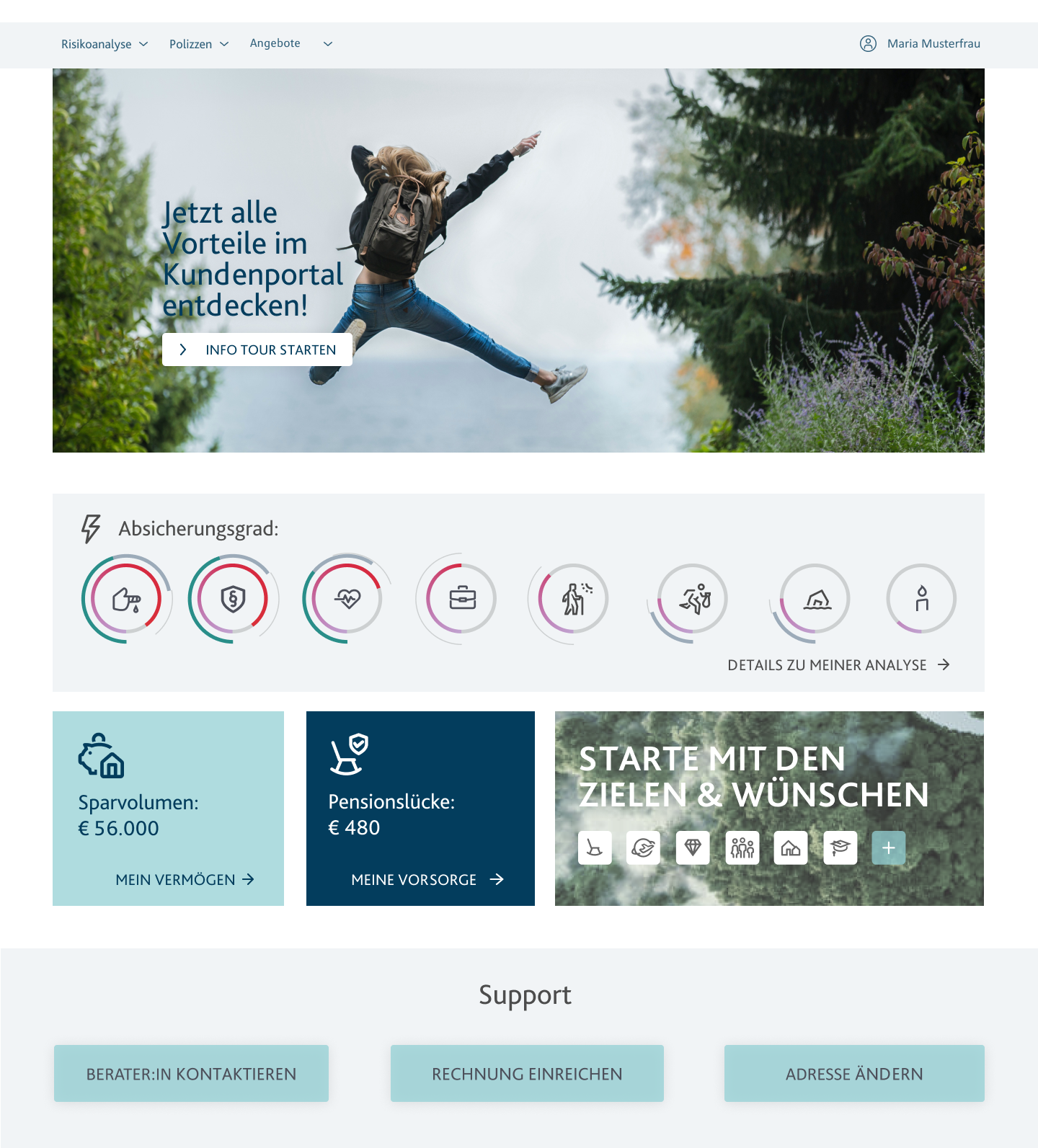

Insurance companies already offer added values to increase the regular interaction with customers, but these often do not lead to a higher usage. This is where our solutions tie in. With individual self-service platforms we not only optimize existing processes, but also create customer centricity at the same time.

Let’s say goodbye to standard dashboards and move on to a more individual approach. From integrating the personal protection level, information about achieved savings goals or the current pension gap. We create individual solutions according to your requirements or, if you wish, we are happy to support you in creating a holistic advisory solution. Let's talk about the possibilities 😊.

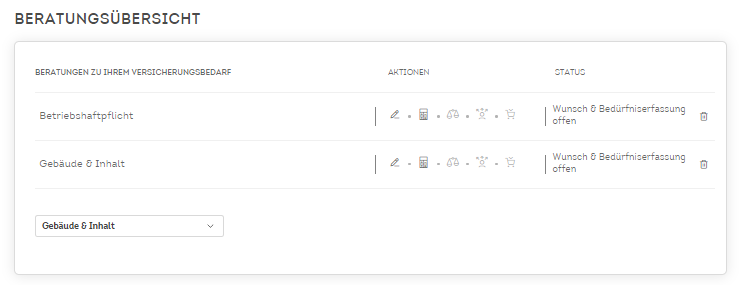

First and foremost, we separated the tendering and calculation sections for brokers. In doing so, we not only managed to drastically reduce the complexity, but also enable private customer experts to carry out advisory sessions for business customers. The newly added feature to bundle tenders also saves time for brokers.

Another innovation is our "advisory hub", which is an improvement for both brokers and insurers. All advised products, including actions and status, are now neatly summarized.

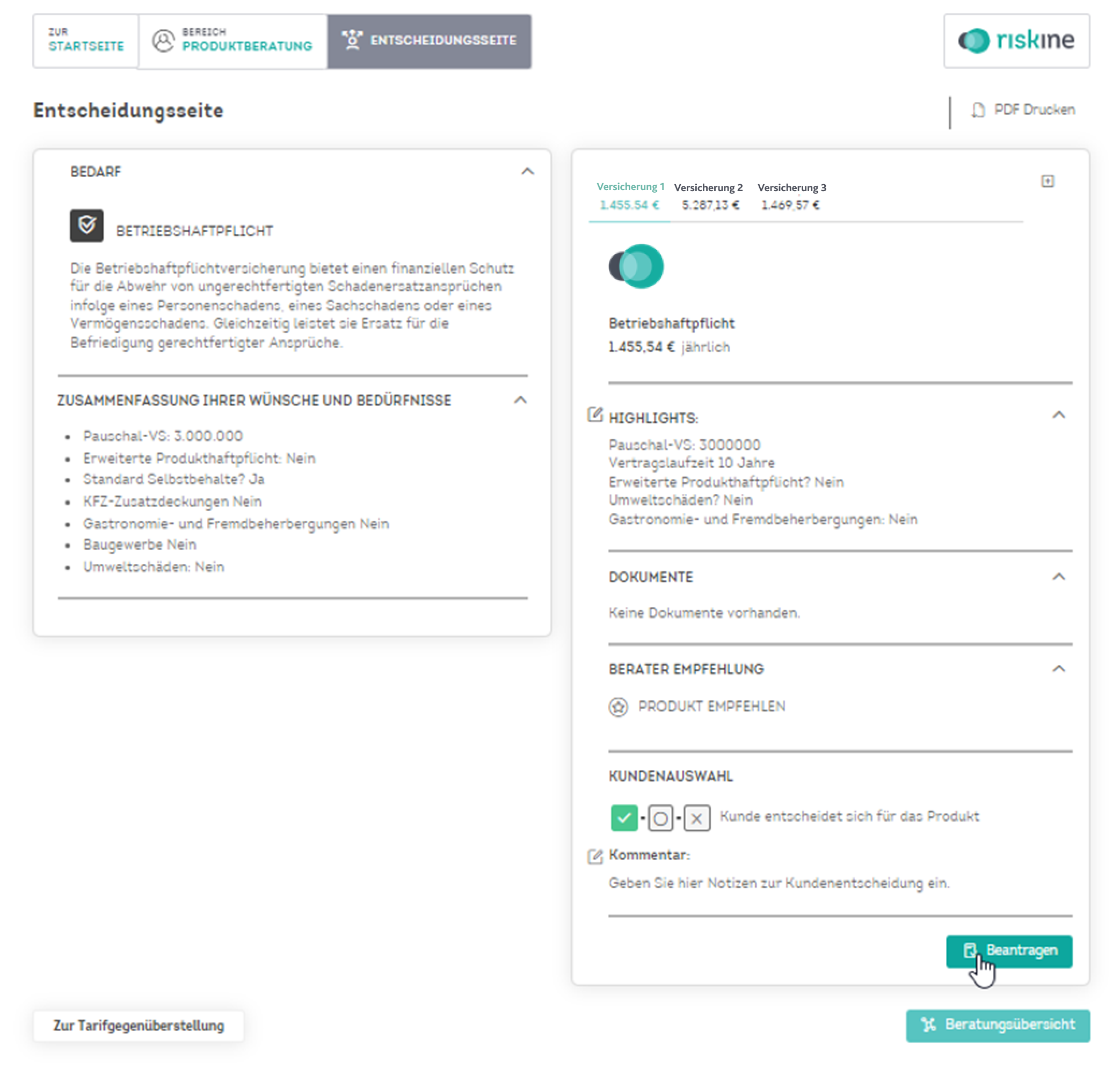

The decision page on the other hand creates a clear summary of wishes & needs as well as a documentation of the advisor recommendation.

Overall, we improved the UX and added several new features. Thanks to the new design, the advisory protocol is now much more appealing. And in case you are already wondering, yes, the question sections retain their intelligence, are still industry-dependent and represent 30 lines of business. The insurance companies and lines of business that can be calculated are being successively expanded.

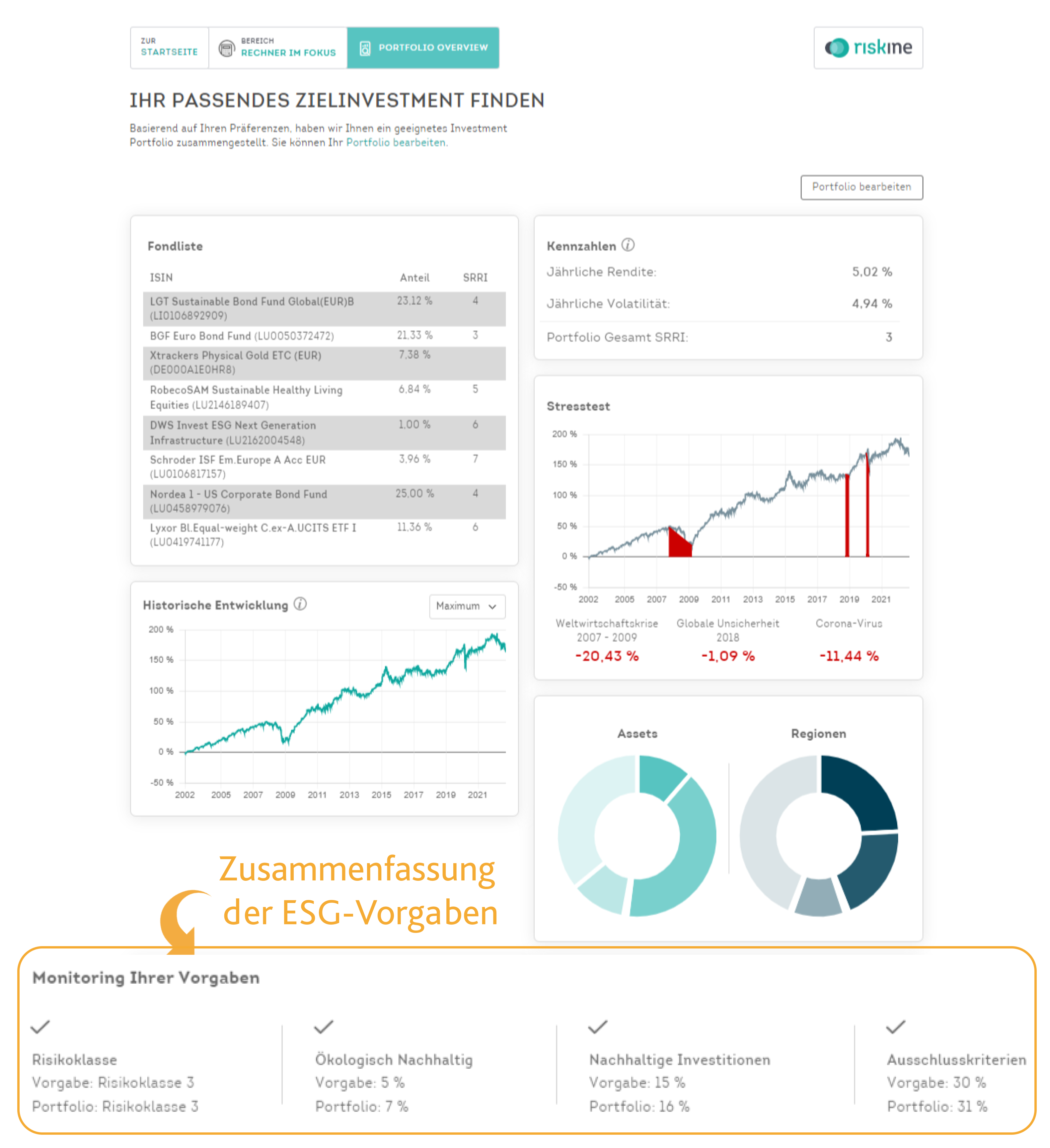

In mid-November the results of a survey by MORGEN & MORGEN made people sit up and take notice, because most insurance companies do not (sufficiently) take the legal requirements for querying sustainability preferences into account. Our latest upgrade of the Portfolio Planner shows that it can be done differently.

Based on your fund list, you receive suitable portfolios for your customers with one click, including consideration of the selected risk class and ESG requirements. Key figures, historical performance and the stress test additionally support you in providing high-quality and transparent advice.

Details about our Portfolio Planner can be found on our website.

Interessted to click through our solutions and receive updates on our product innovations? As a user of our PRO demo solution you are always up to date.

Find more details about riskine online...