Good advice in uncertain times

...and why it’s important to keep an eye on sustainability 🌱

An unpredictable world, permanently facing new crises, creates new challenges, changes priorities and triggers economic and social insecurity and questions. Perhaps you have already been asked by friends and acquaintances for an investment advice due to the high inflation?

As a result, sustainability agendas are taking a back seat. This reaction is understandable, but it is also important to maintain a forward-looking perspective. So does the EU with driving developments in the financial sector towards more sustainability, resulting in new laws and regulations regarding the integration of ESG criteria.

For this reason, we have set the following priorities in the current newsletter:

- Advice in uncertain times

- Sustainability in the financial industry: investment & underwriting

Advice on switching to life insurance products with higher returns/better inflation protection is regulatory "sensitive" and therefore requires high quality advice.

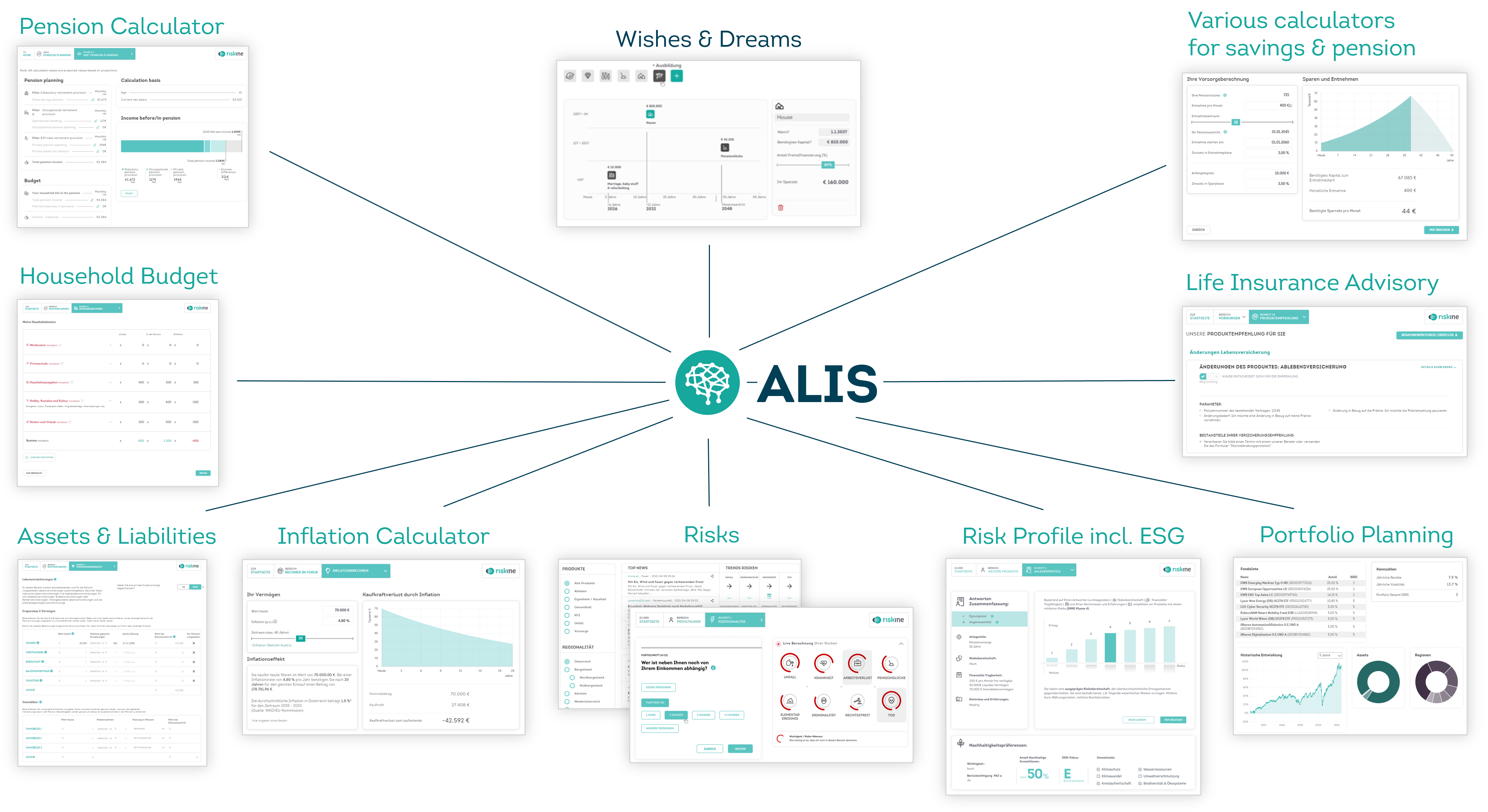

For this reason we constantly keep an eye on these topics and refine our digital advisory solutions accordingly. Thus we ensure that our API-based modules, build-up around our financial planning algorithm ALIS, cover these requirements.

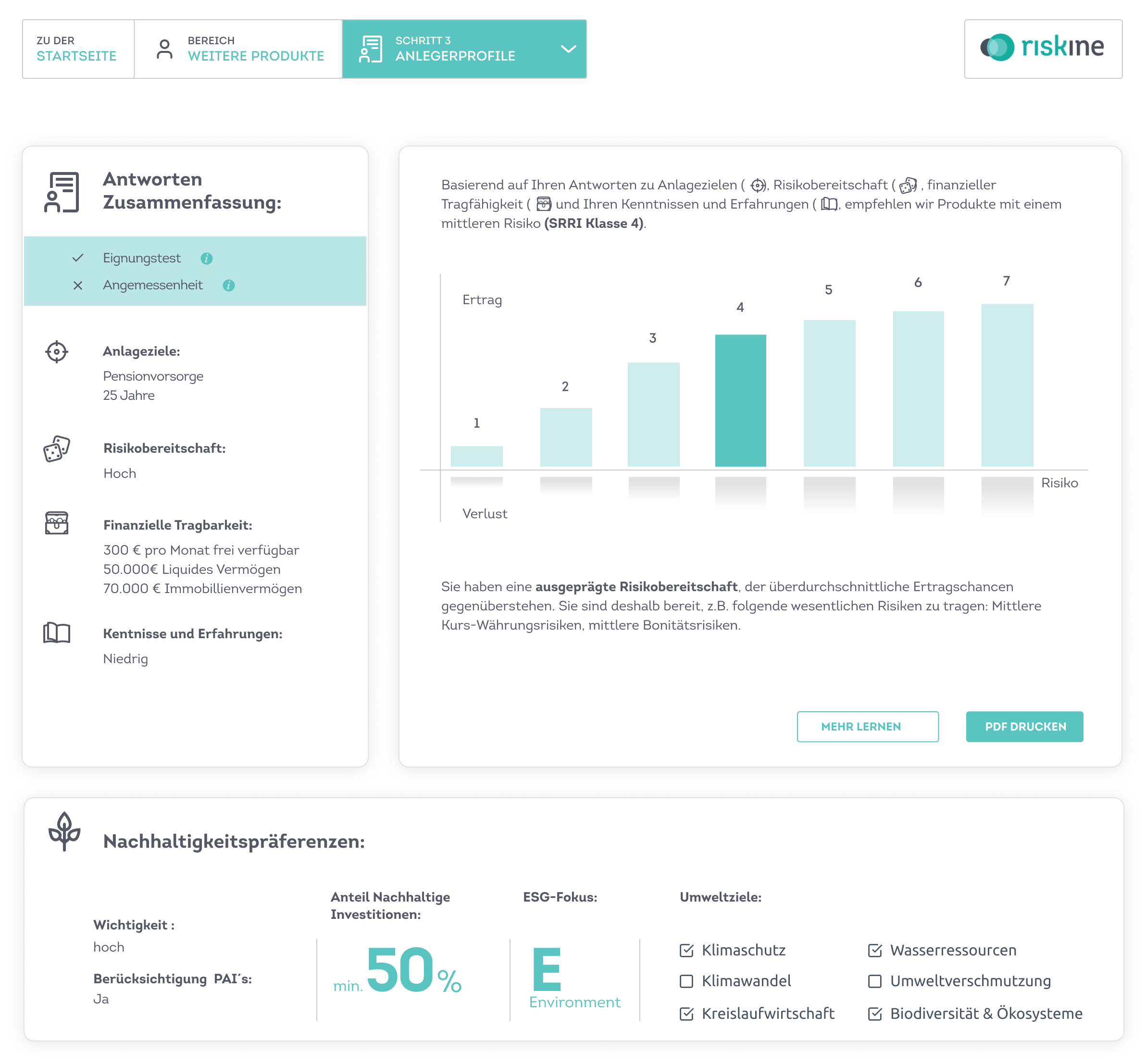

Our investment profile, not only enables transparent advice but also meets regulatory requirements. Investment goals, risk preferences, financial viability as well as knowledge and experience of your customers are recorded holistically. Plus, ESG preferences are also part of the questionnaire and, together with the inclinations of your customers, presented in a comprehensible manner.

By using intelligent questionnaires, the ESG Analyser provides CO2e emissions (Scope 1-3), EU taxonomy relevance, physical climate risks, as well as other essential ESG risks and benchmarking data for your SME customers. The ESG Analyser is not only based on important industry standards but also connected to the most relevant sustainability databases.

Interessted to click through our solutions and receive updates on our product innovations? As a user of our PRO demo solution you are always up to date.

Find more details about riskine online...

.png)

.png)