Protection Gaps: from awareness to action

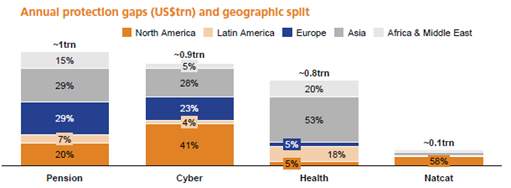

Protection gaps touch the core of the value proposition of the insurance industry. However, compared to other “trending headlines” like digitalization or AI, they receive far too little attention. Reason enough to summarize what has happened since the GFIA report visualized the four most significant protection gaps relating to trends with global relevance, including a connection to our riskine advisory products.

- Climate change: Nat-Cat protection gap

- Ageing population: Pension gap

- Ageing population, rising morbidity and advancing medical capabilities at high costs: Healthcare protection gap

- Technological acceleration and dependency: Cyber security gap

Source: GFIA report, page 7

The levers to mitigate those different risks can be classified as follows:

- Loss prevention, e.g. through flood protection, primary prevention in healthcare

- Loss reduction, e.g. through building regulations, new products like parametric insurances to reduce the settlement costs or secondary prevention in health management

Very often both levers go hand in hand with regulatory interventions, for instance by supporting the private sector products with tax benefits (e.g. levers for pension products), regulatory required insurance (e.g. flood protection in some countries) or building regulations.

#1 Nat-Cat: Climate change and a rising number of incidents lead to a growing attention on how to address the rising underinsurance gap in natural disaster coverage.

Referring to the recent Insurance Law Day 2024, existing coverage concepts with partially low sums, exclusions or no coverage at all, once more were questioned and declared to be “inadequate”. The crucial question is, can more prevention (recently proposed by the German Insurance Association) or innovative products solve the problem? Or do we need a fundamental rethink like the Belgian model, where the legislator introduced mandatory natural catastrophe coverage for everyone with fire insurance coverage back in 2005?

Aside from discussions on creating new regulatory regimes, the focus lies on improving risk modeling and enhancing risk mitigation as well as developing new products such as parametric insurances. Rather than actual losses, the payout in parametric insurances is based on predefined triggers (parameters), such as wind speed or rainfall. The UNDP-Generali partnership is a great example of how parametric insurance can help governments, businesses and communities to financially prepare for rising risks.

Advisory solutions such as the riskine Risk Analysis help to understand which natural catastrophes are at high risk using GPS coordinates of customers’ home addresses. Based on implementations, such as HORA in Austria, we not only raise awareness for risks but also visualize individual needs for protection.

Source: Screenshot riskine Risk Analysis

#2 Pension: Financial planning is no longer a taboo subject for Austria's youth. According to a study from Uniqa only 2% of the surveyed 16-to 25-year-olds trust that the state pension is sufficient. Considering the Gender Pay Gap especially 48% of women fear a lower pension income. However, a recent Generali Generation Study shows that only 13% rate their insurance knowledge as very good. This is, according to the results, probably one of the reasons why only 27 % of 18- to 25-year-olds make their own decisions about their insurance and pay for it.

Insurers are already addressing this issue by creating awareness of the need to save for retirement and offering innovative and flexible products.

We as riskine are strongly supporting insurers for many years with products such as the Retirement Planning Calculator, “Start vs. Wait” Calculator, or the 360° Retirement Planner. Thereby, we identify pension entitlements of state, company and private pensioners to determine the total pension income as well as a possible household cost gap.

Source: Screenshot riskine Risk Analysis

Article as PDF?

The download starts automatically when submitting your email address.

#3 Health: We are still facing increasing differences in the quality and availability of healthcare services, which is why the number of private healthcare policies has been growing steadily over the last years (38,4% in Austria with a plus of 4,4% over the last four years). In addition to flexible insurance products, insurance companies are also focusing on health promotion and prevention. From creating transparency to annual health checks and apps with gamification elements, customers are encouraged to take care of their health and set certain measures.

However, the healthcare protection gap is set to increase further, due to the growing population and the rising average life expectancy. We are facing the question of affordability, not only for insurers and public healthcare, but also for policyholders.

Awareness is key when it comes to enabling customers to make sound financial decisions. Our newest addition, the age simulation as part of our Risk Analysis is only one example. The newly added feature visualizes different risks and issues that become relevant throughout life and thus regular reviews and adjustments of existing insurance and retirement products are necessary to avoid protection gaps.

Source: Screenshot riskine Risk Analysis

#4 Cyber Security: The recently published paper from MarshMcLennan and Zurich once more underlines the importance of closing the gap in cyber security with a steadily rising number of incidents worldwide (see map from KonBriefing). Particularly SMEs are often underinsured, as cyber threats are exceeding the capacity of traditional insurances. However, due to the relatively high claims cost, e.g. in critical infrastructure cases, the financial loss that can be absorbed is limited.

“Both the insurance industry and the public sector are urged to collaborate, share, and innovate to confront the growing cyber risk protection gap, foster resilience, and safeguard our society and economy from the escalating cyber threat landscape.”

MarshMcLennan and Zurich report, Closing the cyber risk protection gap, 2024

Using a predefined question flow, our business customer solution especially supports SME businesses in identifying their risks and needs. For a comprehensive advisory service product- and industry-specific advisory paths are supplemented by various intelligent calculators.

In a nutshell:

Through rising incidents, we do see further developments when it comes to setting measures for closing protection gaps. However, we are facing a lot of challenges and blind spots which seem to need both private and public attention and resources for a sustainable concept and long-term solutions. Awareness is a first and important step for addressing these topics.

We as riskine see our contribution small but nevertheless important in supporting our insurance clients with advisory software that enables their customers to make sound financial decisions.