Risks, wishes and dreams at the centre

of holistic customer-centric advice

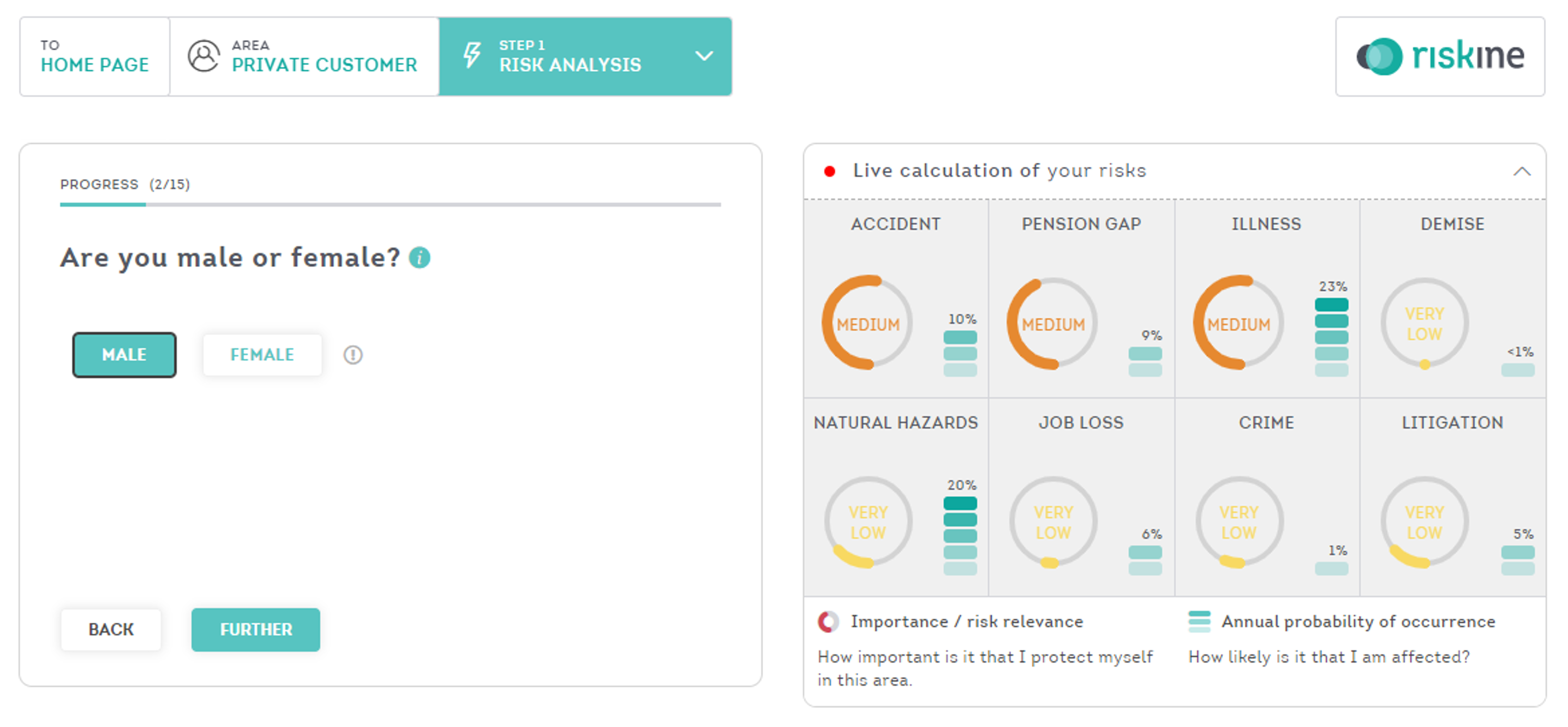

The digitalization is on the go and not only changes the way we work, but also the demands of customers. Hybrid and self-service solutions are becoming a "must have" to ensure a 24/7 availability as well as to handle simple inquiries and product closings. These quick and easy solutions and self-service components also affect the tasks of insurance advisors.

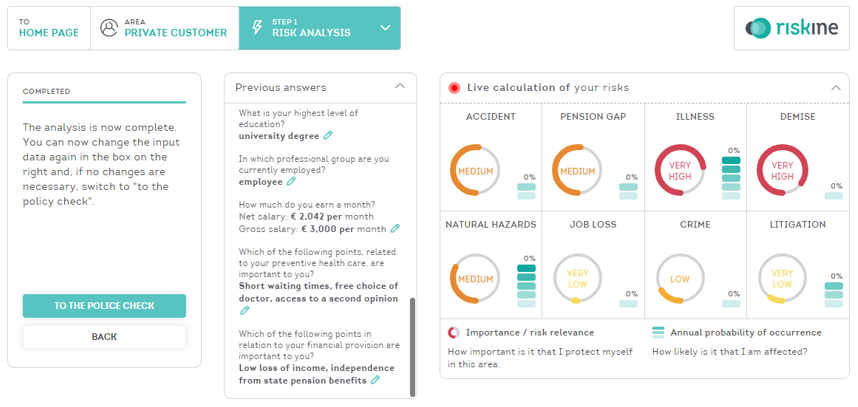

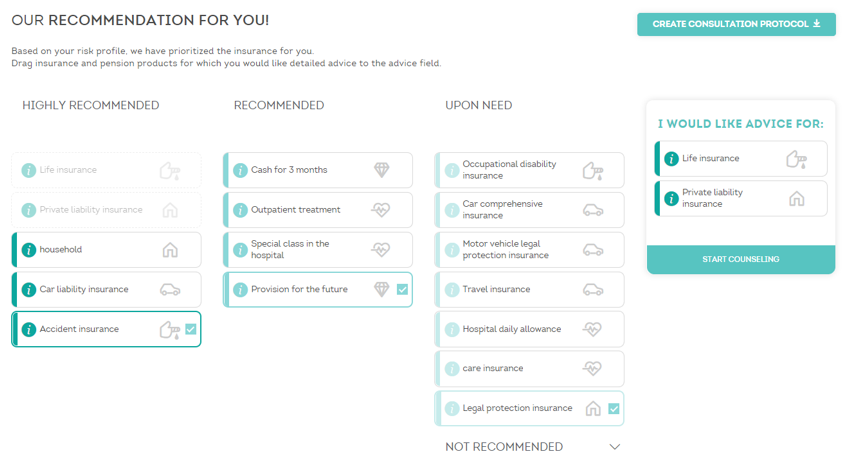

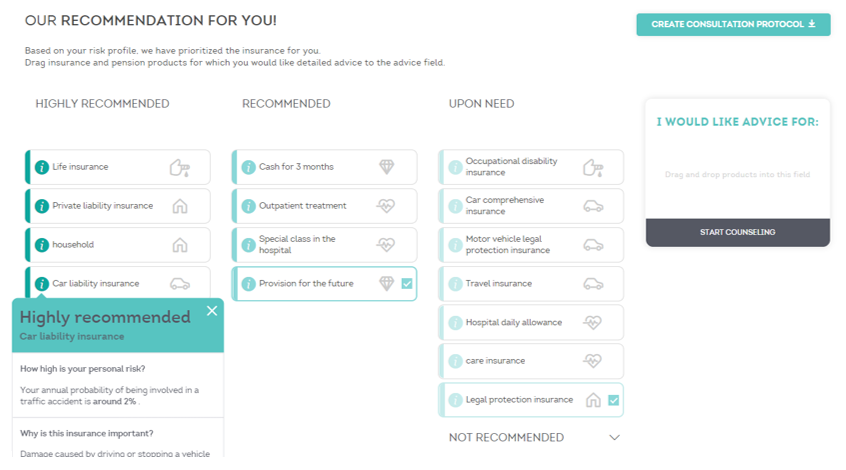

Insurance companies have the opportunity to differentiate themselves through "holistic advice" and thus "advice quality" not only from their competitors, but also from purely price-driven transactions via platforms. We are facing that insurance advisors are evolving more towards “holistic risk managers” by accompanying their customers through their lives with the help of modern IT solutions.

However, conventional advisory solutions quickly reach their limits when it comes to customer centricity, as they are not able to display risks, preferences or wishes and dreams of customers. This deficiency extends from user surfaces to data structures.

A 360° customer view leads to sustainable customer relationships. It is therefore recommended to have a good mix of digital solutions and personal contact, depending on the preferences of the customers.

See our website for more details: www.riskine.com

You are interessted to try our solutions and to receive updates on our product innovations? Register as PRO demo user and you are always up to date.

Feel free to contact us directly using the button below, we look forward to your inquiry.